Maximize Your Returns with Cfd trading in Forex Market

Trading in financial markets is amongst the most gratifying careers. It offers a distinctive possibility to make money by guessing the path from the market. Even so, trading can also be unsafe, and many investors lose cash. Agreements for Distinction or Cfd trading is undoubtedly an innovative strategy to be involved in the stock markets. Within this post, we are going to deal with all that you should know about Cfd trading.

1. Precisely what is Cfd trading?

cfd trading is surely an device that allows forex traders to speculate about the selling price motions of primary assets for example stocks and shares, indices, currencies, and products. It is a derivative product which permits forex traders to look at jobs on an asset without the need of actually having it. Instead, traders speculate around the route from the root asset’s selling price, as well as their profit or reduction is dependent upon the real difference in between the opening and closing cost of the career.

2. How Does Cfd trading Operate?

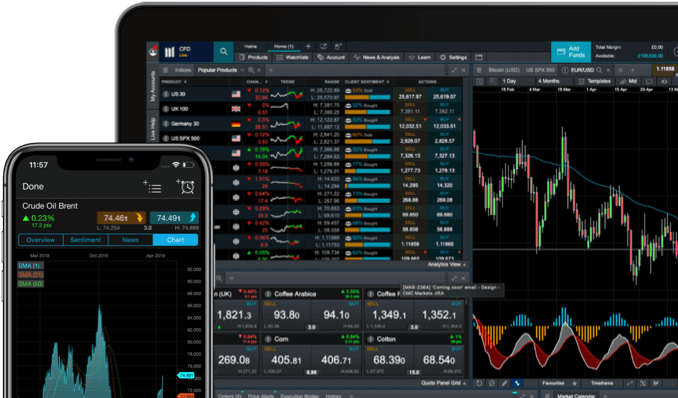

To start trading CFDs, you need to sign up having a regulated dealer that gives CFDs. When you have opened up your account, it is possible to downpayment cash into it and initiate trading. You can trade CFDs on a variety of markets, which include shares, indices, foreign currencies, and items. You can acquire (go very long) or promote (go short) a CFD based upon your market perspective. If you consider the market will increase, it is possible to go very long, and if you consider it can drop, it is possible to go simple. The net profit or reduction depends upon the visible difference in between the closing and opening expense of the career.

3. Advantages of Cfd trading

Cfd trading delivers several positive aspects when compared with standard trading. Among the benefits of Cfd trading is influence. With Cfd trading, you are able to buy and sell a larger place than your bank account harmony. Which means you can make a bigger earnings with a more compact expenditure. Another advantage of Cfd trading is the capability to go extended or simple over a market. It is possible to cash in on both soaring and sliding markets. Cfd trading also provides entry to an array of marketplaces, including stocks and shares, indices, currencies, and merchandise.

4. Perils of Cfd trading

Although Cfd trading may be profitable, it is also unsafe. One of the hazards of Cfd trading is influence. While influence can amplify your earnings, it can also enhance your losses. Another risk of Cfd trading is market unpredictability. Markets could be unpredictable, and abrupt selling price actions could lead to significant failures. Traders also need to be familiar with the risks related to trading with unregulated broker agents. Legislation supplies traders with safety, and traders should only trade with regulated agents.

5. Strategies for Effective Cfd trading

To become a productive CFD forex trader, you should have a trading program and self-discipline. A trading prepare is a pair of policies and recommendations which you adhere to when trading. It allows you to stay focused and prevent psychological trading choices. Self-control is also crucial in Cfd trading. Forex traders must have the self-control to keep with their trading plan, deal with their risk, and steer clear of impulsive trading choices. Forex traders must also maintain up-to-date with market reports and evaluation to identify prospective trading opportunities.

In short

In conclusion, Cfd trading is an impressive approach to take part in the financial markets. It provides several positive aspects when compared with classic trading, but it is also risky. Dealers need to be aware of the health risks and also a trading program and self-control to have success. Cfd trading supplies use of a wide range of market segments, such as stocks, indices, currencies, and items. With all the right approach, Cfd trading could be a profitable business.